Since insurers make use of different aspects to cost rates, the cheapest insurance provider prior to an offense probably won't be the most inexpensive after. underinsured. Our evaluation found that while Geico had the least expensive average yearly price for an excellent driver with minimal protection, after a DUI the rate boosted by more than 150%, pressing the company out of the top five most inexpensive companies for an SR-22 in The golden state - sr-22.

The issuing agency likewise must have a power of lawyer on data in Illinois. sr22. The SR-22 should be sent on a Monetary Obligation Certification from the office of the insurance provider. The SR-22 certificate is provided in among the following types: Operator's Certification covers the vehicle driver in the procedure of any kind of non-owned car (sr22 coverage).

dui sr22 auto insurance insurance group insurance

dui sr22 auto insurance insurance group insurance

The sort of lorry have to be provided on the SR-22 or may be provided for all had automobiles. Operators-Owners Certificate covers all lorries had or non-owned by the driver. When settlement is made to an insurance policy firm, the agent will certainly send a request for an SR-22 certificate to the main office. no-fault insurance.

liability insurance driver's license underinsured vehicle insurance credit score

liability insurance driver's license underinsured vehicle insurance credit score

The individual will certainly get a duplicate of the SR-22 from the insurance provider as well as a letter from the Secretary of State's workplace. The insurance needs to be maintained for three years. If the SR-22 ends or is cancelled, the insurance policy business is needed by legislation to alert the Security as well as Financial Obligation Area by a SR-26 Termination Certification.

Out-of-state locals may request their evidence of monetary obligation for Illinois be forgoed by finishing an Testimony. The sworn statement uses just to Illinois' insurance demands (dui). In case you relocate back to Illinois within three years from acceptance of the insurance coverage waiver, your SR-22 need for Illinois would certainly be restored.

Not known Factual Statements About How Long Do I Have To Carry An Sr-22 License After Dwi In ...

The SR-22 demand starts on the day of the conviction. The SR-22 requirement begins on the date of the crash (vehicle insurance).

The SR-22 need starts when you obtain the license and also ends when the authorization runs out. Please get in touch with DMV to see if you require to get an SR-22. Out of State Declaring, Even if you endure of state, you should file an SR 22 with Oregon (if required) prior to an additional state can release you a driver certificate.

What is an SR-22? An SR-22 is a certification of monetary obligation needed for some vehicle drivers by their state or court order. An SR-22 is not an actual "kind" of insurance policy, but a form submitted with your state. This type acts as evidence your automobile insurance plan fulfills the minimum responsibility insurance coverage called for by state law.

Do I need an SR-22/ FR-44?: DUI sentences Careless driving Crashes created by uninsured motorists If you need an SR-22/ FR-44, the courts or your state Electric motor Car Division will certainly notify you.

coverage underinsured auto insurance sr22 insurance ignition interlock

coverage underinsured auto insurance sr22 insurance ignition interlock

Is there a cost associated with an SR-22/ FR-44? This is a single fee you should pay when we file the SR-22/ FR-44.

The Best Strategy To Use For Sr-22 Insurance In Texas: What Is It? How Much Does It Cost?

A filing cost is billed for each and every specific SR-22/ FR-44 we file. If your spouse is on your plan as well as both of you need an SR-22/ FR-44, then the declaring fee will certainly be billed two times (auto insurance). Please note: The cost is not included in the rate quote since the declaring fee can vary.

underinsured sr-22 insurance department of motor vehicles insurance sr-22 insurance

underinsured sr-22 insurance department of motor vehicles insurance sr-22 insurance

How much time is the SR-22/ FR-44 legitimate? Your SR-22/ FR-44 must stand as long as your insurance plan is energetic. If your insurance plan is canceled while you're still called for to bring an SR-22/ FR-44, we are needed to notify the proper state authorities. If you do not keep constant protection you might shed your driving privileges.

Greet to Jerry, your new insurance policy representative. We'll call your insurance policy company, examine your present strategy, then locate the protection that fits your requirements and conserves you cash. bureau of motor vehicles.

department of motor vehicles deductibles coverage sr-22 auto insurance

department of motor vehicles deductibles coverage sr-22 auto insurance

How to Get SR-22 Insurance Coverage in Illinois, A court may get Illinois SR-22 insurance if your driving history includes numerous small traffic infractions, a sentence for driving drunk, expired permit plates, points on your driving document, or circumstances of driving without state-mandated insurance protection (underinsured). You can likewise go through this high-risk vehicle driver demand if you have averted highway tolls, stopped working to pay child support, or did not pay damages as gotten after creating a car mishap (vehicle insurance).

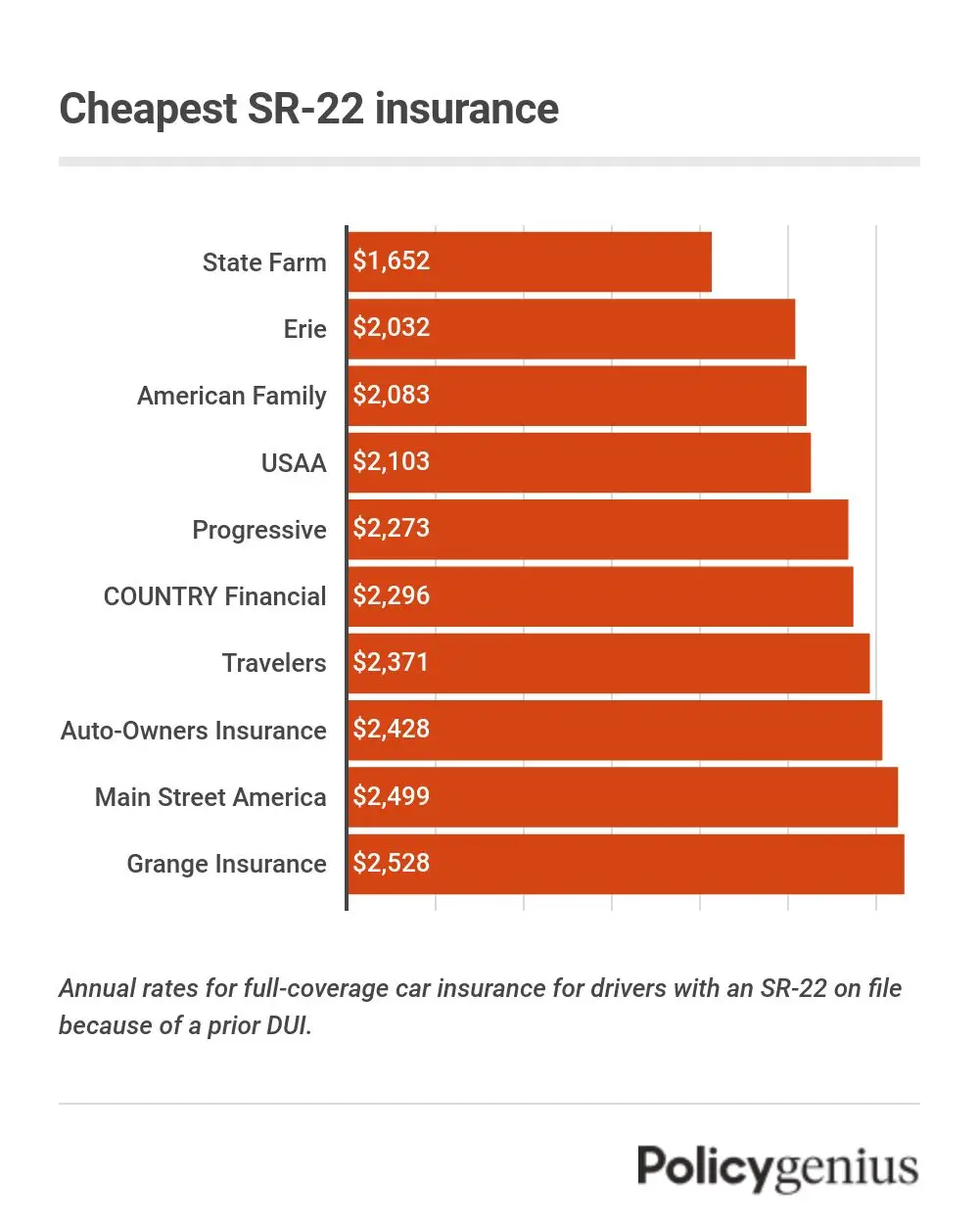

You need to restore your SR-22 plan at the very least 45 days prior to expiry. The state will be informed if you have not yet restored a policy that will run out within 15 days. Cost of SR-22 Insurance Policy in Illinois, The finance internet site Cash, Geek looked into the most budget-friendly business in Illinois for SR-22 insurance coverage.

The Greatest Guide To What Is Sr22 Insurance? - The Balance

This is the amount you pay of pocket if you have a car repair case. A greater deductible lead to a lower month-to-month premium. Purchase greater than one kind of plan from Find more info your automobile insurance policy service provider. For instance, you could additionally require property owner's insurance policy, renter's insurance coverage, or car insurance for one more chauffeur in your house.

Check this out if you require extra info, sources, or guidance on car insurance policy - car insurance. This web content is developed as well as preserved by a third celebration, and also imported onto this web page to aid individuals provide their email addresses. You may have the ability to discover more details about this and similar material at.